This piece was inspired by a LinkedIN piece and study by Sundar Swaminathan

In the fast-paced world of tech and startups, companies often focus on rapid growth and quick wins. But let’s be real—building a brand that sticks isn’t about sprinting to the finish line. It’s about pacing yourself for the long haul. The story of Uber Eats in 2018 is a perfect example of what happens when a company takes its foot off the gas in the race for brand awareness. While Uber was busy optimizing its ad spend and cutting costs, it inadvertently handed over significant market share to competitors like DoorDash and Grubhub. Today, we’re diving into how Uber’s decision to cut Meta (Facebook) ad spend in 2018 may have backfired, and why building a brand is more like running a marathon than a 100-meter dash. 🏁

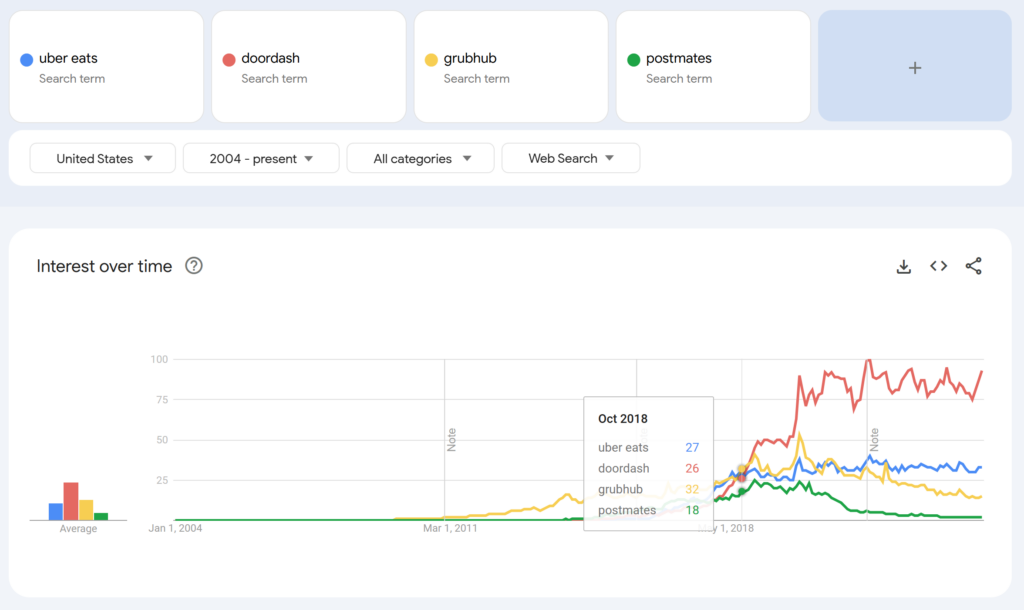

Google Trends: Racing Against The Tides 🏁

From October 2018 clearly illustrates the pivotal moment when DoorDash surged ahead of Uber Eats in the US food delivery market. While Uber Eats maintained a stable but unremarkable trajectory, DoorDash experienced a significant uptick in search interest, reflecting its growing popularity and market presence. This shift aligns with DoorDash's aggressive expansion strategies, localized marketing campaigns, and customer-centric approach, which resonated strongly with consumers. Meanwhile, Uber Eats, despite its established brand, showed no appreciable change in search interest, suggesting a plateau in its growth. This divergence in trends underscores the importance of continuous brand investment and innovation in maintaining market relevance, as even a brief lapse can allow competitors like DoorDash to seize the lead. 🚀📈

The Context: Uber’s Meta Ad Spend Cut 💸

Back in 2018, Uber made a bold move to cut $35 million in annual ad spend on Meta (Facebook). The decision came from an internal analysis led by Sundar Swaminathan, who was heading up US & Canada Rider Performance Marketing Analytics at the time. The analysis showed that Meta ads weren’t driving new customer acquisition for Uber Rides anymore—the market was pretty much saturated. Uber’s data suggested that almost everyone in North America who was going to use Uber already was, so pouring more money into Meta ads seemed like a waste. 🛑

On paper, it made sense. Save money, right? But here’s the kicker: Uber Eats, the company’s food delivery arm, was still in growth mode. By cutting Meta ad spend, Uber may have weakened its brand presence in the food delivery space, leaving the door wide open for competitors like DoorDash to swoop in and steal the show. 🚪🍔

Uber Eats vs. DoorDash: The Battle for Market Share 🥊

In 2018, DoorDash pulled ahead of Uber Eats to become the second-largest food delivery service in the US, right behind Grubhub. According to Second Measure, a firm that tracks consumer spending, DoorDash’s market share jumped from 17% in January 2018 to 27% by December 2018. Meanwhile, Uber Eats’ share stayed flat at around 20%, and Grubhub held onto the top spot with 34%. 📊

DoorDash’s Secret Sauce 🍔🔥

So, how did DoorDash do it? Well, they didn’t just throw money at the problem. They built a brand that resonated with both customers and delivery drivers. Here’s how:

- Customer-Centric Approach: DoorDash focused on delivering a great experience. They offered a wide variety of restaurants, including local favorites, and made sure deliveries were fast and reliable. Their DashPass subscription service was a game-changer, giving frequent users free delivery for a monthly fee. Who doesn’t love a good deal? 🎯

- Driver-Friendly Policies: DoorDash knew that happy drivers meant happy customers. They offered competitive pay, flexible hours, and bonuses for working during peak times. This helped them attract and retain a massive pool of delivery drivers, which kept deliveries speedy and customers satisfied. 🚗💨

- Localized Marketing: DoorDash didn’t just blanket the country with generic ads. They ran localized campaigns that connected with communities. By partnering with local restaurants and running region-specific promotions, they built a strong local presence that felt personal. 🏘️🍕

- Digital Dominance: DoorDash went all-in on Meta (Facebook) and Instagram ads, email marketing, and even influencer partnerships. While Uber was scaling back, DoorDash was doubling down, ensuring their brand stayed top-of-mind for hungry consumers. 📱💻

- Storytelling: DoorDash’s marketing wasn’t just about selling a service—it was about telling stories. They highlighted real experiences from customers and drivers, creating an emotional connection that made people feel good about choosing DoorDash. 📖❤️

Did Uber’s Meta Shutdown Help DoorDash? 🤔

Here’s where things get interesting. Uber’s decision to cut Meta ad spend in 2018 may have indirectly given DoorDash a leg up. Here’s how:

- Less Competition for Ad Space: With Uber out of the picture, DoorDash had more room to dominate Facebook and Instagram ads. This meant they could reach more potential customers without competing with Uber for attention. 🎯📈

- Increased Brand Visibility: As Uber scaled back its marketing, DoorDash’s continued investment in Meta ads likely boosted its brand visibility. This helped DoorDash capture the attention of consumers who might have otherwise gone with Uber Eats. 👀🍔

- First-Mover Advantage: Uber’s focus on cost-cutting may have slowed its expansion into new markets, giving DoorDash a first-mover advantage in suburban and rural areas. DoorDash’s aggressive expansion strategy allowed it to establish a strong presence in these regions before Uber could catch up. 🏞️🚀

Other Players in the Game: Postmates and Grubhub 🎮

While DoorDash was making waves, other players like Postmates and Grubhub were also in the mix. Postmates, known for its “deliver anything” model, grew modestly in 2018, going from 10% to 12% market share. They focused on urban markets and partnerships with local businesses, which kept them competitive but not quite as explosive as DoorDash. 🏙️📦

Grubhub, the market leader at the time, held onto its 34% share but started to feel the heat as DoorDash and Uber Eats gained traction. Grubhub’s strategy relied heavily on its first-mover advantage and its large network of restaurant partnerships, but it struggled to keep up with DoorDash’s aggressive growth. 🍴📉

The Big Lesson: Brand Building is a Marathon 🏁

Uber’s experience in 2018 is a cautionary tale for any company thinking about cutting corners on brand building. Here’s the deal:

- Market Saturation Isn’t Forever: Even if your market seems saturated, consumer behavior can change. You’ve got to keep investing in brand awareness to stay relevant. 🔄📈

- Competitors Never Sleep: In a competitive market, taking your foot off the gas can give your rivals a chance to zoom past you. DoorDash’s rapid growth in 2018 is proof that maintaining a strong marketing presence is crucial. 🏎️💨

- Brand Awareness is a Long-Term Game: Building a brand isn’t a one-and-done deal. It’s a continuous effort that requires consistent investment. Companies that treat brand building like a marathon, not a sprint, are the ones that come out on top. 🏃♂️🏆

Conclusion 🎬

Uber’s decision to cut Meta ad spend in 2018 may have saved them $35 million, but it cost them dearly in the food delivery race. By scaling back its marketing efforts, Uber Eats lost ground to DoorDash, who capitalized on the opportunity by building a brand that resonated with customers and drivers alike. The takeaway? Brand building is a marathon, not a sprint. In competitive markets, maintaining a strong brand presence is critical to long-term success. 🏁🍔

As Sundar Swaminathan put it, “insights do not mean action.” While Uber’s decision to cut Meta ad spend was data-driven, it highlights the importance of considering the bigger picture. In the race for market share, companies that prioritize long-term brand building will always have the edge. 🧠📊

References 📚

- Second Measure: DoorDash Overtakes Uber Eats in US Food Delivery Market Share

- Sundar Swaminathan: How Uber Saved $35M a Year on Ads (experiMENTAL Newsletter, 2024)

- Grubhub Investor Relations: 2018 Earnings Report

- Postmates Market Share: Second Measure - Postmates Growth